|

Are you a Small Business Owner in California? Do you know what came in to effect today, January 1st 2018?

The CA legislative branch has continually come up with more ways to protect the employee, hundreds to be exact!

Just this past October (2017) our governor signed 859 of the 977 employment related bills that came to his desk, only vetoing 118. If you're a small business owner in California, then you've probably noticed in recent years this "pile-on" of laws by the state legislation and have already been trying to make sense of the quagmire.

As a Small Business Coach here in California, now more often than not, I am telling my small business clients “you need to hire a lawyer”. This is because the laws are so numerous, and often extremely complicated, that interpretation and implementation are fraught with pitfalls.

Some recent bills I have found to be so impacting that businesses are seeing adverse effects on their business model. In some cases, I have seen employee-related expenses potentially skyrocketing, putting in jeopardy the very jobs the State intends to protect.

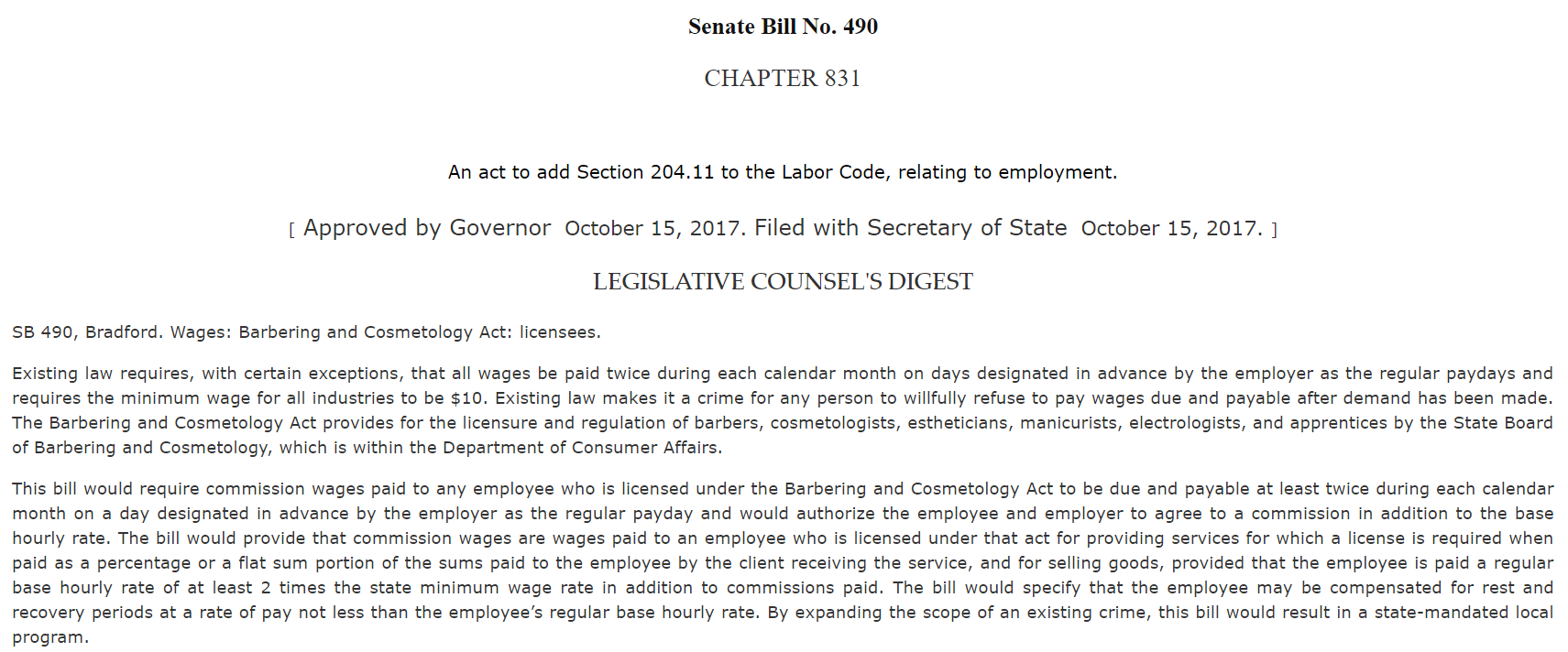

Take for instance, SB-490 that comes in 2018; barber shops, hair salons, spas and beauty salons are required to pay twice the State minimum wage for commissioned wages to licensed barbering and beauty employees. I'm not going to delve too deeply into this one now, but here's a snippet/link of the bill to check it out later:

In short, for a salon spa client of mine, and probably many of the businesses in this industry, this is going to be a hard pill to swallow. Spa and salons already have very tight margins, especially here in California. Payroll tends to be in the 60-70% range of overall expenses before this law comes in to play (when paying current minimum wage, plus commissions).

A conservative interpretation of this new 490 bill would potentially push payroll to 85% or more of total expense. This is forcing these owners to look at ways to adjust their business models and reduce the impact of this bill. (Note: I do not interpret laws; that should be accomplished by an employment attorney, which I am not. This was an estimate based on a specific interpretation of the law, but the text of this particular bill I found extremely difficult to interpret. The impact may differ, depending on an attorney's interpretation.)

So what can be done? How can you as a small business owner in California weather the storm?

Here are 4 things that you can do to help prepare your business:

1) Get professional legal advice when interpreting these new and recent laws.

Work with a business/employment attorney, especially if you are in an industry that has recently been affected, like the example above.

Get to know which laws impact your business, what's already in place and what's forthcoming. This is your responsibility as a business owner, and it's just wise to do so.

Understand how your business is affected. For instance, some laws have lowered the number of employees limit from 50 to 25 before you have to comply. This means you could now be out of compliance in some cases.

2) Hire a Small Business Coach to help review any impacts to your expenses and bottom line.

A business coach can help you redefine your business model to limit impacts and mitigate risks.

I am continually working with the business attorneys of my clients to analyze bills like these and understand the impacts to their bottom lines. I help them understand how, and to what extent, they can adjust their business models to lessen the impact. I expend a lot of effort helping them understand that the need is even greater to assess the business model in light of new rules.

3) Ask your payroll company for help with your HR and employee policies.

Many payroll companies have options for HR and policy management.

Payroll companies provide their services in a streamlined way, thus helping the business owner keep track of all these entangled employment requirements. They can provide you with an HR consultant to review all your current policies and get the right policies and procedures in place. This ensures you are in compliance with all the new laws. They also provide services such as creating employee handbooks and safety manuals that can get your documentation where it needs to be.

4) Sign up with California business advisory groups to stay informed.

One such group is the CalChamber, with their HRCalifornia Extra newsletters. They regularly send out information about new and changing laws here in California. They also send Alerts when potential bills move through the State assembly and Senate floors.

So here is my advice to sum it up:

Your New Years resolution as a CA business owner should be to become more informed and get well advised. Thus, hopefully, avoid losing a potential lawsuit in the future, and get some small business coaching advise on how to keep your business model "weather-proof" in this ever-changing California climate.

Contact INFIX and we can work out if you need to reassess your business model in light of these new and changing laws.

To sign up for a FREE 60-minute small business consultation, click the button below and my Calendly schedule will pop up. Choose your spot and calendar it and we’re good to go!